Never let your sense of morals prevent you from doing what is right.

Isaac Asimov, Foundation

Introduction:

The coordinated efforts and activities in the field of Anti-Money Laundering (AML) accelerated in 1989 when the Group of Seven nations launched the Financial Actions Task Force FATF in Paris. FATF provides guidance to governmental bodies around the world. Other groups, established over the last 20 years, define standards for their target audience, like the Wolfsberg Group for large banks.

Financial crimes can be grouped into three areas:

1) Sanctions (including embargos and restricted persons)

2) Money laundering and terrorist financing

3) Bribery and corruption

Sound know-your-customer (KYC) procedures to detect sensitive clients form the base of the three areas. Red flags, escalation and reporting accomplish the financial crime prevention framework.

The accelerated pace of new standards in recent years force financial institutions to quickly assess the impacts on their financial crime frameworks as well as to update the underlying procedures and processes. The increasing number of criminal investigations of industry peers as well as payments for staggering fines for violating economic sanctions show the importance of a sound and robust financial crime prevention framework. Several stories of banks and non-financial businesses and professions illustrate the legal and reputational consequences of non-compliance with respective financial crime prevention laws.

However, the challenges for financial institutions lie in transforming the national and international standards in financial crime prevention into daily operation. The risk-based approach in FATFs recommendations adds flexibility but also complexity and increases the challenges in defining a firm's financial crime framework.

How to align procedures and processes in such a way that a financial institution's Compliance and Operations departments can manage detected alerts and suspicious activities?

How to fine-tune the software solutions for monitoring, screening and searching transactions and customers to distinguish true hits from false alerts?

Your Challenges:

How effective and efficient is your firm's financial crime prevention framework? What areas of improvement exist?

What are the cost savings potentials in operating the framework? How can they be achieved?

How effective and robust are your AML and Combating the Financing of Terrorism (CFT) procedures and processes?

What are the possible impacts on your firm's financial crime prevention framework in case of new standards and regulations?

How up-to-date are your existing solutions and tools you use to monitor, screen and search transactions and customers?

Financial crime prevention together with sound and robust AML and CFT policies and procedures are regulatory musts. Monitoring, screening and searching transactions and customers to detect suspicious activities require sophisticated software solutions but also investments in continuous staff training.

Leveraging and adapting such software solutions to cover both settlement and operational risks add value and protect a firm from loss of funds due to settlement failures with counterparties at risk or due to human error. Lehman Brothers in 2008 showcased how quickly financial institutions can stagger when a major counterparty fails. Even if most of such funds can be recuperated the costs and damage could have been avoided.

Experience how mmeli consulting can support you in being best in class in financial crime prevention and operational risk mitigation.

Services:

Financial Crime Prevention

A firm's framework to prevent financial crimes like money laundering, terrorist financing, sanction breaches and bribery & corruption cases becomes increasingly important and also costly.

-

Organizational and technical assessment of efficiency and effectiveness of the firm's financial crime prevention framework

-

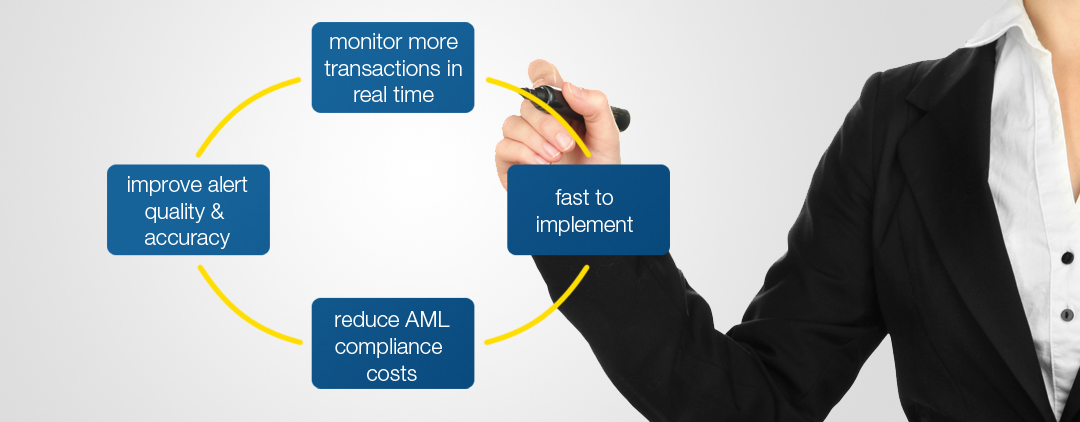

Review and improvement of AML and CFT processes and procedures (monitoring, escalation and reporting)

-

Analysis how latest rules and regulations impact and affect the framework, procedures and processes

Operational Risk Protection

A firm's screening solution to detect suspicious activities in financial crime can also be applied to operational risk screening as a last line of defense.

- Assessment of how to best re-use the firm's screening solution for operational risk protection

Project Management

- Implementing AML and CFT screening solutions

- Realizing operational efficiency programs

Coaching and Training

- Executive coaching

- Customized training for staff

Competencies:

Profile

- Broad experience in Banking Operations and IT holding senior manager positions in Core Banking, Securities Services and Investment Banking Operations

- Profound expert knowledge in AML (anti-money laundering) screening solutions and algorithms (e.g. fuzzy logic, relaxed pattern matching)

- Experienced project manager for implementing AML and CFT screening solutions and operational efficiency programs

Career History

| since 2015 | Managing Director at MMeli Consulting | |

| 2006 - 2015 | UBS, Zurich - Head of Global Compliance and Risk Screening Infrastructure | |

| 2000 - 2006 | UBS, Zurich - Head Client Reporting & Output Management Services | |

| 1999 - 2000 | UBS, Zurich - Project Manager Operations Merger | |

| 1998 - 1999 | UBS, London - Banking Advisory Consultant in Emerging Markets | |

| 1985 - 1998 | Swiss Bank Corporation SBC, Zurich - Project Manager Custody Services |

Key Success Stories

- Achieved up to 50% reduction in Total Cost of Ownership (TCO) in Global Compliance and Risk Screening Infrastructure

- Global roll-out of a Compliance and Risk Screening Infrastructure within time, budget and agreed functions

- Reached up to 20% reduction in TCO in Output Management Services

- New high-quality client asset reporting implemented within the shortest time

Professional Education

- Cert. Anti-Money Laundering Specialist CAMS

- Cert. Integral Coach ECA

- Dipl. Mental- & Stress-Coach ECA

- Certificate Advanced Executive Program Swiss Finance Institute

- Diploma Executive Program Swiss Banking School

- Business Administrator HF Zurich Business School

Memberships

- Association of Certified Anti-Money Laundering Specialists ACAMS

- Alumni Swiss Finance Institute

"Marlène Meli is acknowledged for her track record to transfer AML and CFT standards into operational efficient and effective solutions. Her strong analytical and organizational skills, the performance-oriented mind-set together with her coaching and training experience make her your ideal partner to manage your challenges in financial crime prevention."